Today, Arcep is publishing its scorecard for the fixed broadband and superfast broadband market in France as of the end of September 2025.

ROLLOUTS: As of 30 September 2025, 93.5% of premises in Metropolitan France were eligible to subscribe to a fibre plan, with close to 3 million remaining to be passed

- At the end of September 2025, optical fibre coverage stood at 93.5%. Of the 45 million premises in Metropolitan France inventoried by operators, more than 42 million are passed for FttH, while 3 million still remain to be covered.

Over the course of Q3 2025, 430,000 additional premises were passed for FttH – or 28% fewer than in Q3 2024.

220,000 additional premises in lower density, public-initiative areas were rendered eligible for FttH access, with 1,410,000 premises remaining to be covered.

160,000 additional premises in lower density, private-initiative areas were rendered eligible for FttH access, with 960,000 premises remaining to be covered.

30,000 additional premises were passed for FttH in those areas covered by calls for expressions of local interest (called "zones AMEL" in French), with 75,000 premises remaining to be covered.

20,000 additional premises in very high density areas were passed for FttH, with 470,000 premises remaining to be covered[1].

As of 30 September 2025, 42.9 million premises (or 95.5% of inventoried premises) were covered by fixed superfast broadband services (fibre, VDSL2, cable).

Monitoring FttH rollouts in “AMII” and “AMEL” areas

Arcep is responsible for monitoring operators’ compliance with the commitments[2] they have made, and publishes regular progress reports on their deployments.

At the end of September 2025, in those parts of the country where the Government has issued a call for investment letters of intent ("zones AMII"):

around 95% of the premises for which Orange has made a commitment had been made eligible for fibre access;

and around 98% of those in municipalities where SFR has made a commitment had been made eligible for fibre access.

Details regarding the progress of individual “AMEL” project commitments (i.e. legally binding FttH rollout commitments that certain operators[3] have made to local authorities, as part of calls for expressions of local interest) can be found in pages 17 to 21 of the publication.

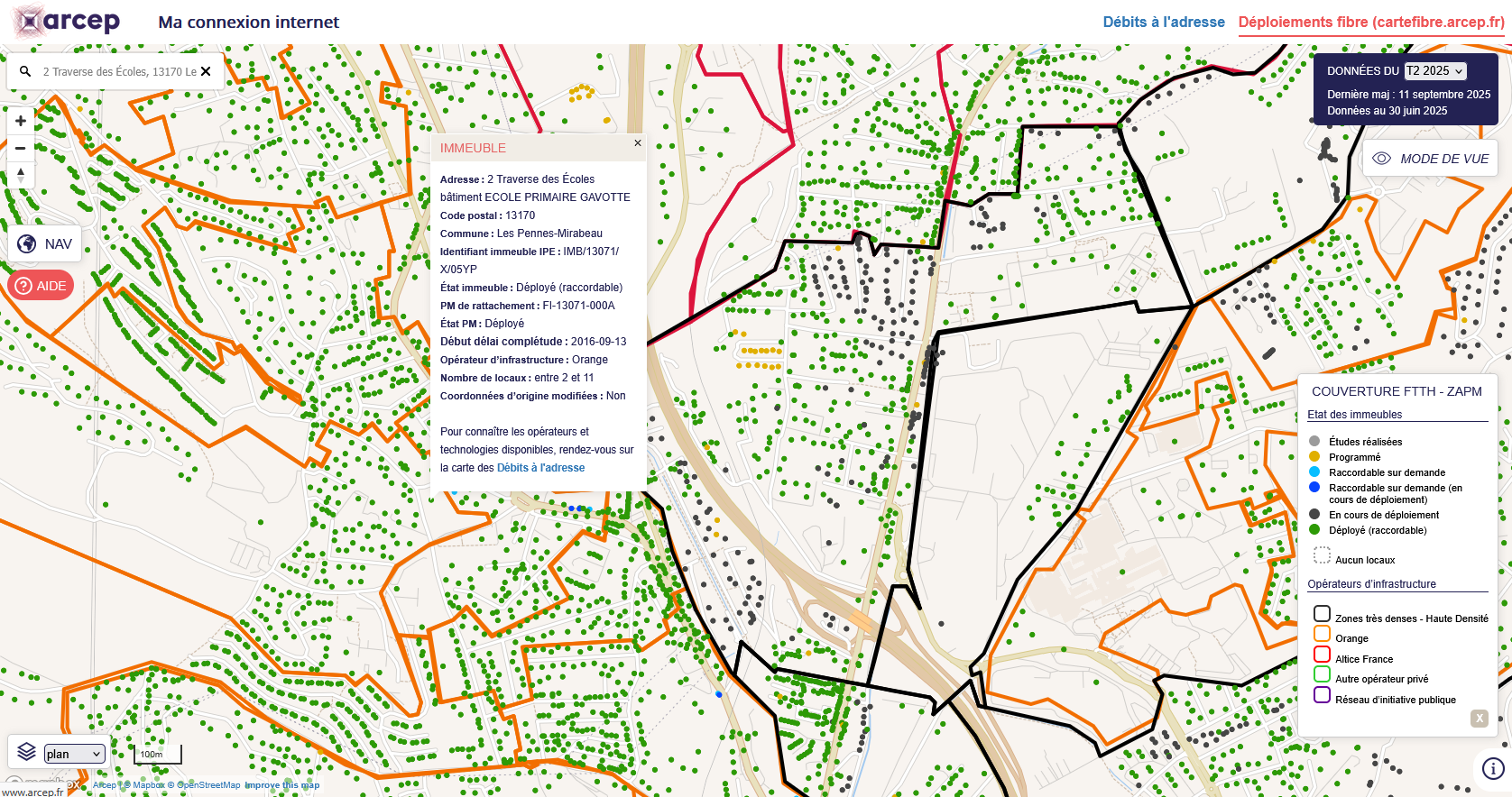

Tracking FttH rollouts with “Ma connexion internet”

The “Déploiements fibre” maps on the “Ma connexion Internet” website (formerly cartefibre.arcep.fr) allow users to track the progress of FttH rollouts in a very detailed fashion.

The information associated with these rollout maps is available as open data.

SUBSCRIPTIONS: As of end September 2025, 26.3 million internet subscriptions in France were to a fibre (FttH) plan, or 80% of all fixed plan subscriptions.

Subscriptions to fibre plans grew by 610,000 in Q3 2025, compared to + 680,000 in the third quarter of 2024. Despite a decrease in the pace of rollouts over the past three years, progress in subscription numbers remains steady. The number of FttH subscriptions thus stood at 26.3 million at the end of September 2025, which represents 80% all internet subscriptions and 93% of all superfast internet subscriptions.

The increase in FttH subscribers is the main reason for the ongoing growth of superfast broadband subscriptions (+ 450,000 in Q3 2025, compared to + 560,000 in Q3 2024). In addition to fibre, these subscriptions include VDSL2, cable, satellite, superfast wireless and fixed 4G and 5G plans. Total superfast broadband subscriptions stood at 28.3 million as of 30 September 2025, or 86% of all internet subscriptions in Metropolitan France.

- The number of “classic” broadband subscriptions continues to shrink, albeit at a slower pace each quarter. In Q3 2025, their numbers decreased by 370,000, compared to a decrease of 520,000 in Q3 2024. The total number of “classic” broadband subscriptions thus stood at 4.5 million as of 30 September 2025.

- The number of broadband and superfast broadband subscriptions reached 32.8 million as of 30 September 2025. The pace of quarterly growth has increased slightly, with 90,000 additional subscriptions recorded over the course of Q3 2025, compared to an increase of 50,000 in the third quarter of 2024.

Associated documents

Scorecard for fixed broadband and superfast broadband services – figures for Q3 2025

“Ma connexion internet”, to obtain detailed information on fixed internet access coverage, particularly thanks to FttH rollout maps (which are also still available at https://cartefibre.arcep.fr/)

Open data: fibre datasets and data on all access technologies

[1] This weak growth can be attributed in part to a temporary decrease in the number of homes passed by infrastructure operator Réseau Optique de France (-31,000 in a single quarter), due to structural repairs on its “large capacity” shared access points (PMGC in French) (Arcep regulation in support of connected territories – 2025 Annual report - Volume 2)

[2] https://www.arcep.fr/la-regulation/grands-dossiers-reseaux-fixes/la-fibre/les-engagements-de-couverture-fibre-en-zone-moins-dense.html

[3] Altitude Infra subsidiaries (Coraï, PIXL), Orange, XpFibre, and XpFibre subsidiaries (Saône-et-Loire THD, Savoie Connectée)