This morning, Arcep is presenting its annual review of the status quo in France’s telecoms market, along with the measures being taken as part of its commitment to pro-investment regulation. It will also outline the work being done at Arcep today, notably on network quality and availability across every region, and on the digital industry’s environmental footprint. This sixth edition of the “Telconomics” press conference coincides with the publication of the 2020 annual observatory, which includes key economic data on the French telecoms market.

2020: another year of outstanding drive from operators

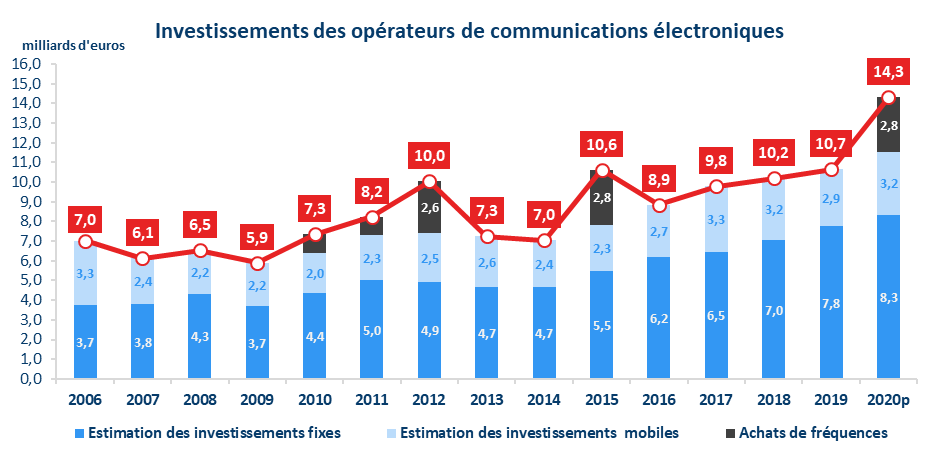

In 2020, operators’ investments (excluding spending on 5G spectrum) reached 11.5 billion euros, which marks an 8.1% increase YoY, compared to the average 4.5% increase over the two previous years. When including spending on 5G spectrum, operators’ investments in 2020 totalled 14.3 billion euros.

This rise in spending can be attributed chiefly to operators’ increased investment in FttH network deployment, but also to the start of 5G network rollouts

2020 was a banner year for FttH deployment, with an additional 5.8 million premises passed for fibre, bringing the total number of premises eligible for FttH services in France to 24.2 million at the end of 2020. Alongside this record increase in deployment was an unparalleled rise in the number of subscriptions to superfast access plans: +3.3 million YoY (compared to +2.4 million in 2019). This rise is due entirely to the growing number of FttH subscriptions, which stood at more than 10 million at the end of 2020.

Operators’ revenue saw its smallest decrease in 10 years (-0.4% YoY in 2020), which was due primarily to a decrease in mobile handset sales during the first lockdown. Aside from device sales, revenue from electronic communications services alone was up 0.3% in 2020, after two years of roughly 1% losses. This slight uptick went hand in hand with a contained increase in fixed(+1.9% YoY) and mobile (-1.7% YoY) service prices.

Consumers radically altered their usage habits on fixed and mobile networks during the Covid-19 crisis in 2020. Both fixed and mobile voice calling levels increased substantially (by +17% and + 8%, respectively, YoY) while the number of SMS plummeted to an unprecedented degree (-16% YoY). Data traffic, meanwhile, continues to soar, with active users on 4G networks generating an average of more than 10 Gb a month.

Associated documents

• Fixed and mobile service price index for 2020

• Slides of the press conference (English version) (pdf - 547 KB)