This morning, Arcep is delivering its annual “Telconomics” progress report on France’s telecoms market to coincide with the publication of the 2023 annual observatory. It compiles key economic data on the French telecoms market, along with the fixed and mobile price index for 2023.

This event provides Arcep with an opportunity to:

- Discuss the main workstreams that are underway, including the market analysis decisions for 2024 to 2028 that were adopted in late 2023, stipulating the regulatory conditions for switching off the legacy copper network, as well as the actions Arcep is taking to support French businesses’ digital transformation;

- Offer a reminder that the aim of Arcep regulation is to facilitate ongoing fixed and mobile superfast network rollouts in Metropolitan France and French overseas territories, thanks to efficient investments, notably through network sharing;

- Talk about the issue of digital technology’s impact on the environment, and put Arcep’s actions in this area into perspective;

- Present the different changes to the regulatory framework, and particularly Arcep’s new responsibilities in regulating the data and cloud economy, which are part of Europe’s data strategy.

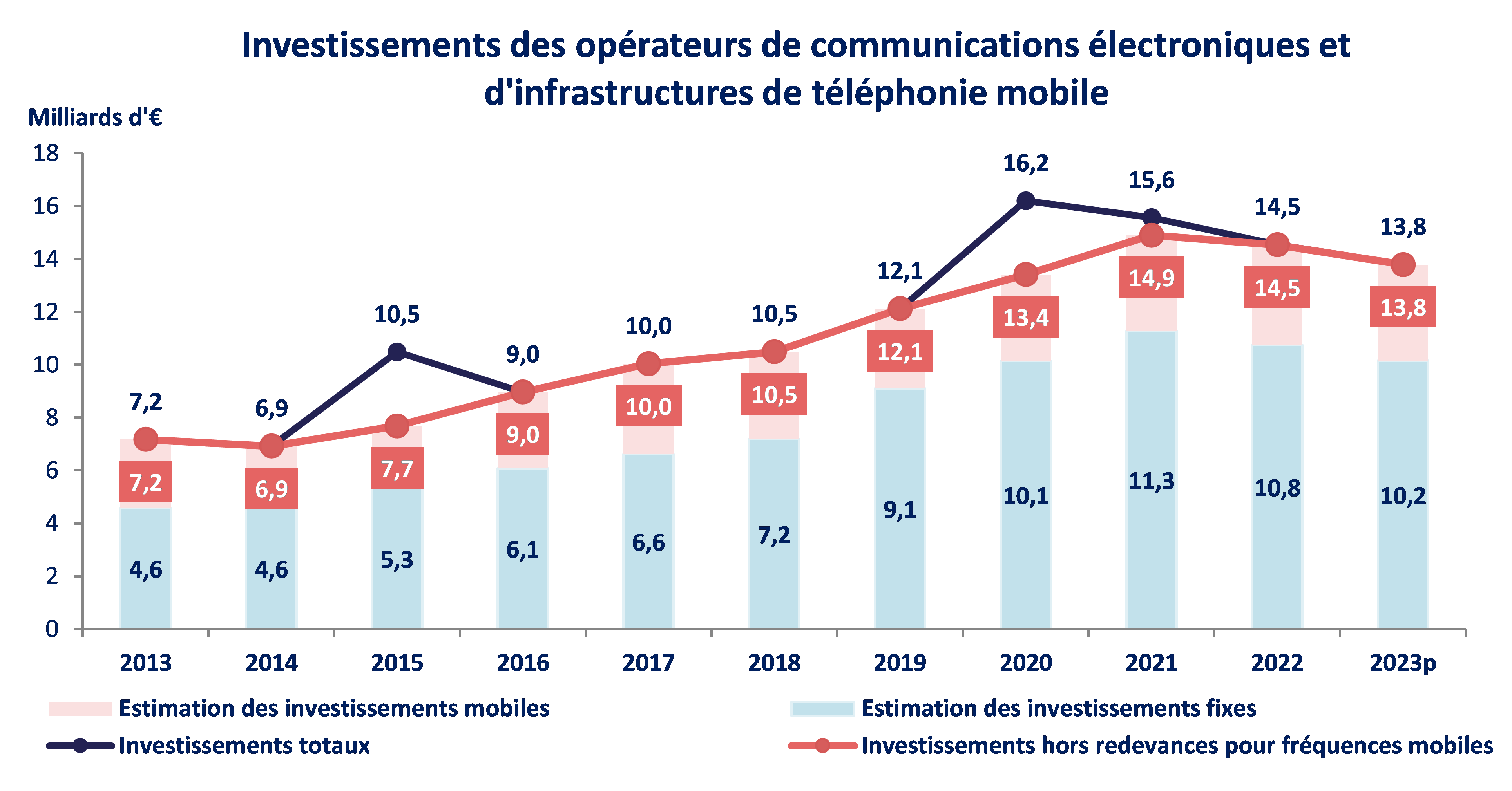

Operators’ spending remained high, despite a 5% decrease in 2023

Electronic communications operators’ and mobile telephony infrastructure operators’ (towercos) investments in 2023 totalled 13.8 billion euros. This marks the second consecutive YoY decrease in spending – which was down by 5.2% in 2023 – that nevertheless remained strong and above pre-2021 levels.

Among these investments, spending on superfast fixed and mobile local loop deployments stood at 7.7 billion euros, or 4% less than in 2022. This decrease can be attributed in part to decreased spending on fixed superfast local loop deployments, which is tied to the smaller number of additional premises passed for fibre last year (+ 3.5 million in 2023 versus + 4.8 million in 2022). It is also due to a decline in spending on mobile superfast local loops in 2023, after three years of steady growth.

Fibre network sharing continues, and mobile network sharing holding steady

Thanks to multiple co-investment schemes that both help stimulate investment and provide operators with guaranteed network access terms and conditions, a growing number of premises passed for fibre have a choice between at least four operators: 83% in 2023 compared to 75% in 2022. Mobile network sharing levels remain stable: 47% of mobile network access infrastructures are shared in Metropolitan France, including 60% in rural areas.

After increasing for two straight years, operators’ nominal retail market income rose by2.5% in 2023

Operators’ fixed services market revenue has been increasing since 2020. In 2023 it rose by more than 2% YoY. This is due to a 5% increase in broadband and superfast broadband services revenue, tied in part to operators’ price increases since late 2022. In the residential market in Metropolitan France, the price of fixed broadband and superfast broadband services increased by 2.8% between October 2022 and December 2023, which drove up the average annual monthly bill for broadband and superfast broadband subscriptions by 4% YoY in 2023.

The mobile market remains dynamic, both for services and operators’ handset sales whose revenue increased by 3% and 5% YoY, respectively, in 2023. The price of mobile catalogue services has decreased, however: in part because of the introduction of new plans with smaller data allowances, which better align with certain users’ needs, and cost less. Some operators’ customers have nevertheless seen the price of their plan increase. Overall, the decrease in the price of catalogue offers and the increase of some customers’ plans has meant a virtually unchanged average monthly mobile phone bill.

As of 31 December 2023, two thirds of all internet subscriptions are FttH, and just under two out of 10 SIM cards have been activated on 5G networks

Of the total 32.2 million fixed network subscriptions, 21.4 million are based on fibre networks (+ 3.3 million YoY). Fibre thus represented 66% of all internet subscriptions in France at the end of 2023 (+ 10 points YoY), and have mainly replaced broadband and superfast broadband plans using the copper network (8.9 million in 2023, -2.7 million YoY). In addition, 14 million SIM cards were being used on 5G networks as of Q4 2023. They represent 17% of the 83.4 million mobile cards in service at the end of 2023 (+ 6 points YoY). The growing number of 4G and 5G mobile network users has gone hand in hand with a surge in data traffic. Operators’ customers generated an average 14.3 Gb of traffic a month in 2023, up 18% YoY.

Associated documents

- Annual observatory for 2023

- Fixed and mobile price index for 2023

- Open datasets

- Press conference slide presentation (English version - pdf – 1 Mo)

- The VoD of the presentation (French version only)