Today Arcep is publishing its annual scorecard that delivers a snapshot of the French telecoms market’s key economic data, along with the fixed and mobile price index. The results of this scorecard, and the effects of the pro-investment regulation implemented by Arcep, will be presented this morning at the fourth edition of the annual Telconomics press conference.

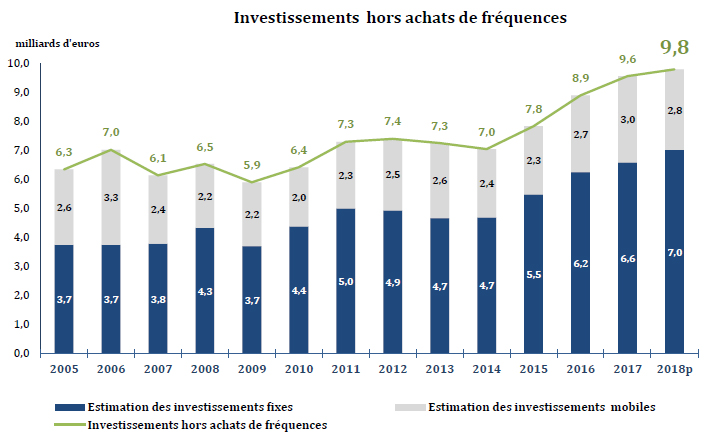

9.8 billion euros: a new record in annual investments (excluding spending on frequencies)

In 2018, operators in France invested 200 million euros more than in 2017, for an overall total (excluding spending on frequencies) of €9.8 billion. Investments have increased by 40% over four years. Arcep welcomes these spending levels, which are vital to meeting the country’s needs.

This increase in spending was accompanied by a slight decrease in operators’ revenue (-1% in 2018), due to a dip in fixed services revenue, whereas mobile services revenue was up for the first time in eight years.

In terms of traffic, mobile network use is still on the rise, both for voice calls (+3.7%) and especially data services whose volume continues to skyrocket (+65% YoY). There are 47.7 million active 4G customers in France (+6.1 million) who consumed an average 6.7 Gb of data a month in 2018. And, thanks the European “roam like at home” regulation that was introduced in June 2017, and put an end to roaming charges inside the EU, French customers’ data consumption when travelling abroad doubled in 2018.

Spending bolstered by the rise of fibre access

Last year’s spending increase can be attributed almost entirely to the rise in operators’ investments in FttH network rollouts: 13.6 additional premises are now eligible to subscribe to a fibre access plan, which represents 7.9 million additional access lines deployed in three years (+3.2 million additional homes passed in 2018). 4.8 million households have now adopted fibre technology, and at a steadily increasing pace (+1.5 million YoY).

Arcep invites operators to stay the course, to be fibre and 5G trailblazers

To be able to rise to the country’s digital regional development and competition challenges, Arcep is calling on operators to maintain their investment momentum: sustaining the steady pace of fibre rollouts and deploying 5G infrastructure will require an unflagging effort. The resulting opportunities could be growth outlets for operators: not only the business market, but also 5G networks with smart cities, Industry 4.0 and connected vehicles.

Associated documents

• 2018 annual scorecard:

► Fixed and Mobile Price Index

• Press conference slideshow (English version) (pdf - 0.93 MB)