Today, Arcep is publishing its scorecard for the fixed broadband and superfast broadband market in France as of the end of June 2024. In Q2 2024, new FttH subscriptions (+ 700,000) slightly outpaced rollouts (655,000 additional premises passed).

ROLLOUTS: As of 30 June 2024, 89% of premises in Metropolitan France were eligible to subscribe to a fibre plan, with around 5.1 million remaining to be passed

- As of 30 June 2024, of the 44.4 million premises in Metropolitan France inventoried by operators, 39.3 million were passed for FttH, and 5.1 million still need to be covered. Fibre coverage reached 87% during the quarter.

- Over the course of Q2 2024, 655,000 additional premises were passed for FttH – or 25% fewer than in Q2 2023.

- 420,000 additional premises in lower density, public-initiative areas were rendered eligible for FttH access, with 2.9 million premises remaining to be covered.

- 130,000 additional premises in lower density, private-initiative areas were rendered eligible for FttH access, with 1.5 million premises remaining to be covered.

- 65,000 additional premises were passed for FttH in those areas covered by calls for expressions of local interest (called "zones AMEL" in French), with 300,000 premises remaining to be covered.

- 40,000 additional premises in very high density areas were passed for FttH, with 500,000 premises remaining to be covered.

- As of 30 June 2024, 40.8 million premises were covered by fixed superfast broadband services (Fibre, VDSL2, cable) which translates into a 92% rate of coverage.

Monitoring operators’ compliance with their FttH rollout commitments[1]

Arcep is responsible for monitoring operators’ compliance with the commitments they have made, and publishes regular progress reports on their deployments.

In Q2 2024, in those parts of the country where the Government has issued a call for investment letters of intent ("zones AMII"):

- around 91% of the premises for which Orange has made a commitment had been made eligible for fibre access;

- and around 96% of those in municipalities where SFR has made a commitment had been made eligible for fibre access.

Details regarding the progress of individual “AMEL” project commitments (i.e. legally binding FttH rollout commitments that certain operators have made to local authorities, as part of calls for expressions of local interest) can be found in pages 19 to 23 of the publication.

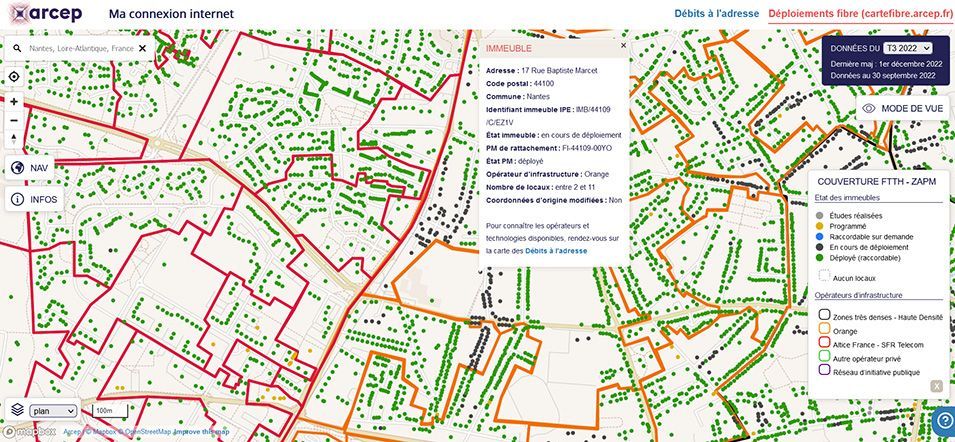

Tracking FttH rollouts with “Ma connexion internet”

The “Déploiements fibre” maps on the “Ma connexion Internet” website (formerly cartefibre.arcep.fr) allow users to track the progress of FttH rollouts in a very detailed fashion.

The information associated with these rollout maps is available as open data.

SUBSCRIPTIONS: As of 30 June 2024, FttH subscriptions in Metropolitan France stood at 23 million, or more than seven out of ten internet subscriptions (71%)

- Subscriptions to fibre plans continue to increase at a significant pace, albeit more slowly than last year: +700,000 in Q2 2024, compared to + 795,000 in Q2 2023. FttH represents 71% of all internet subscriptions and 90% of all superfast internet subscriptions.

- The number of superfast internet subscriptions, all technologies combined (fibre, VDSL2, cable, satellite, superfast wireless and fixed 4G and 5G), rose by 590,000 in Q2 2024 compared to +660,000 in Q2 2023. These superfast subscriptions represent 79% of all internet subscriptions, and stood at 25.5 million as of 30 June 2024.

- Among these broadband and superfast broadband subscriptions, 24.9 million were to superfast plans as of 30 June 2024 and represent 77% (+ 7 points YoY) of all internet subscriptions. Quarterly growth for superfast subscriptions remains strong, but continues to diminish each quarter (+ 675,000 in Q1 2024 vs. in + 770,000 in Q1 2023).

- The number of “classic” broadband subscriptions continues to shrink: - 565,000 in Q2 2024 compared to - 595,000 in Q2 2023. Their numbers had dropped to 6.9 million as of 30 June 2024.

- The number of broadband and superfast broadband subscriptions stood at 32.4 million at the end of Q2 2024. This marks a decreased rate of growth: + 25,000 subscriptions during the second quarter of 2024, versus + 65,000 in Q2 2023.

Associated documents

• Scorecard for fixed broadband and superfast broadband services – figures for Q2 2024

• Maconnexioninternet.arcep.fr, to obtain detailed information on fixed internet access coverage, particularly thanks to FttH rollout maps (which are also still available at https://cartefibre.arcep.fr/)

• Open data: data on fibre and data on all access technologies

To find out more